Inheritance Tax Planning is a strategic approach to minimize taxes on estate transfers for individuals with significant wealth, ensuring assets are preserved and distributed according to their preferences. By consulting professionals in inheritance planning near you, leveraging legal strategies like gift-giving, trust creation, and asset allocation, and staying informed about local tax rules, you can effectively manage your legacy while reducing liabilities. Regular reviews and updates are crucial due to changing laws and personal circumstances. This proactive planning is essential for securing your family's financial future.

“Unravel the complexities of inheritance tax and ensure a smooth transfer of assets with efficient planning. This comprehensive guide explores essential strategies to minimize tax liabilities, offering valuable insights for proactive inheritance planning. From understanding the basics of inheritance tax to seeking expert advice, you’ll discover practical steps to optimize your financial legacy. Find tailored inheritance planning near you, ensuring peace of mind and maximizing the future value of your estate.”

- Understanding Inheritance Tax: The Basics

- Effective Inheritance Planning Strategies

- Seeking Professional Guidance for Optimal Inheritance Planning Near You

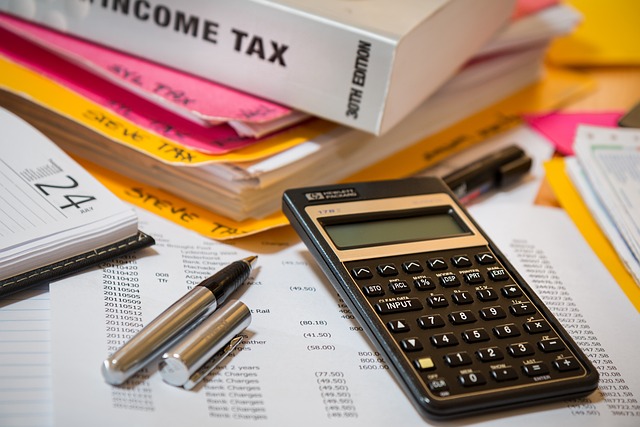

Understanding Inheritance Tax: The Basics

Inheritance Tax is a levy imposed by the government on the transfer of an individual’s assets to their heirs after their death. It can significantly reduce the value of an estate, especially for those with substantial wealth. Understanding this tax and its implications is crucial for effective inheritance planning. The primary goal of Inheritance Tax Planning is to minimize the tax burden while ensuring that your wishes are carried out as intended.

By consulting professionals in inheritance planning near you, you can explore various strategies such as gift-giving, trust creation, and asset allocation to legally reduce the taxable value of your estate. These methods require careful consideration and expert guidance, making it essential to seek advice from financial advisors or solicitors who specialize in this area. Effective Inheritance Tax Planning not only protects your assets but also ensures peace of mind, knowing that your legacy will be managed according to your preferences.

Effective Inheritance Planning Strategies

Effective inheritance planning is crucial for ensuring your assets are distributed according to your wishes while minimising tax liabilities. The first step involves understanding the current inheritance tax thresholds and rules, as they can vary based on location. For instance, in many jurisdictions, there’s an exemption for a certain amount, allowing you to pass on a substantial portion of your estate tax-free. Consult with a financial advisor or lawyer specialising in inheritance planning near you to gain insights tailored to your specific situation.

To further mitigate inheritance tax, consider the use of asset protection strategies and trusts. These tools can help shield assets from potential claims and reduce taxable value. Additionally, life insurance policies can be employed to provide funds for covering any outstanding inheritance tax liabilities, ensuring a smoother transition for your beneficiaries. Regularly reviewing and updating your inheritance planning strategies is essential due to changes in the legal landscape and personal circumstances.

Seeking Professional Guidance for Optimal Inheritance Planning Near You

In light of the above discussions on inheritance tax and effective planning strategies, it’s clear that proactive inheritance planning is key to preserving your estate for future generations. By implementing thoughtful strategies tailored to your unique circumstances, you can significantly reduce or even avoid inheritance tax liabilities. Don’t leave your financial legacy to chance – seek professional guidance from experienced planners near you to optimize your inheritance tax planning and ensure a smooth transfer of assets to your loved ones.