Inheritance planning is a strategic estate management process that goes beyond creating a will, focusing on minimizing tax liabilities, protecting family assets, and ensuring a smooth transition for beneficiaries. Key strategies include understanding inheritance tax thresholds, utilizing exemptions, making lifetime gifts, and holding assets in trust. Seeking professional guidance from experts in "inheritance planning near me" is crucial to create tailored, legally sound strategies that align with personal goals, optimize taxes, and secure a legacy reflective of one's intentions. Regular reviews are essential to adapt to changes in laws and personal circumstances.

Creating a robust inheritance plan is an essential step in securing your legacy. This article explores five critical tips to navigate the complexities of inheritance planning, offering valuable insights for individuals seeking to protect and distribute their assets effectively. From understanding the fundamentals of inheritance tax planning to choosing the right legal professionals, these strategies ensure your wishes are fulfilled while minimizing tax burdens. Discover key considerations for fair asset distribution and the importance of regular reviews to adapt to changing circumstances, all vital aspects of Inheritance Planning Near Me.

- Understanding Inheritance Planning: What It Entails and Why It Matters

- Strategies for Effective Inheritance Tax Planning

- Choosing the Right Legal Professionals for Your Inheritance Plan

- Key Considerations When Distributing Assets Fairly

- Regular Review and Updates: Ensuring Your Plan Stays Current

Understanding Inheritance Planning: What It Entails and Why It Matters

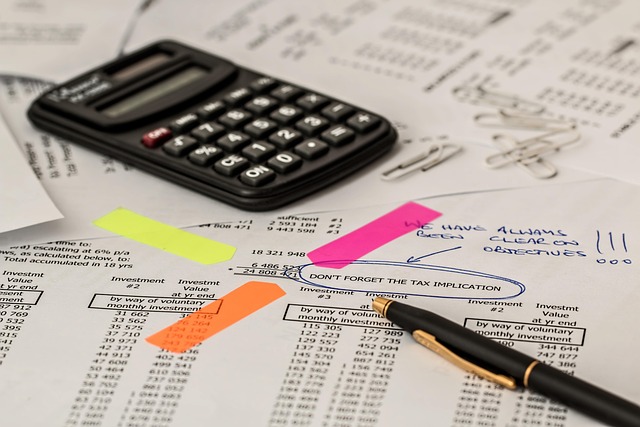

Inheritance planning is a critical aspect of estate management that involves strategic decisions to ensure your assets are distributed according to your wishes after your passing. It’s more than just creating a will; it encompasses a comprehensive approach to minimizing tax liabilities, protecting family assets, and ensuring a smooth transition for beneficiaries. This process is especially crucial in navigating the complexities of inheritance tax planning, which can significantly impact the value of an estate.

Effective inheritance planning requires careful consideration of various factors, including asset ownership, future financial needs of beneficiaries, and legal frameworks governing inheritance. Seeking professional guidance from experts in the field, such as those offering inheritance planning near me, can make all the difference. They provide insights tailored to individual circumstances, ensuring that plans are legally sound, tax-efficient, and aligned with personal goals, thereby securing a legacy that reflects your intentions.

Strategies for Effective Inheritance Tax Planning

Effective inheritance planning involves more than just deciding who gets what. It’s a strategic process that includes careful consideration of inheritance tax implications to ensure your wishes are fulfilled while minimizing tax burden on your beneficiaries. One key strategy is to utilize available exemptions and allowances. Understanding the current inheritance tax thresholds, both for individual and joint estates, can significantly reduce taxable assets. This might involve making gifts during your lifetime, which not only reduces the overall estate value but may also qualify for gift tax exemptions.

Additionally, considering asset placement and timing of transfers is crucial. Holding assets in trust or utilizing retirement accounts can offer tax advantages. For instance, transferring assets to a revocable living trust can help avoid probate, potentially saving on taxes and legal fees. Timing is also important; transferring assets well in advance of when they would be needed can take advantage of lower asset values and ensure your beneficiaries receive what you intended without the added stress of immediate financial obligations. Remember, seeking advice from professionals like attorneys or tax advisors specializing in inheritance planning near me can provide tailored guidance based on your unique circumstances.

Choosing the Right Legal Professionals for Your Inheritance Plan

When it comes to crafting your inheritance plan, selecting the appropriate legal professionals is a pivotal step. This decision can significantly impact the overall success and validity of your estate arrangements. Seek out lawyers and financial advisors with expertise in inheritance tax planning, as they will be adept at guiding you through the complex legal and fiscal aspects.

Consider looking for professionals experienced in handling inheritance planning near me to ensure they’re familiar with local laws and regulations. Their knowledge can help optimize your strategy, minimize potential taxes, and ensure your wishes are accurately reflected in the documentation. These specialists will play a crucial role in executing your plan smoothly and protecting your assets for future generations.

Key Considerations When Distributing Assets Fairly

When it comes to inheritance planning, ensuring a fair distribution of assets is paramount. One key consideration is understanding the tax implications, especially regarding Inheritance Tax Planning. It’s crucial to be aware of the current tax thresholds and rates to minimize any potential burden on your beneficiaries. This involves strategic decision-making, such as gift-giving and trust creation, which can help reduce the taxable value of your estate.

Another important factor is considering the financial needs and circumstances of each heir. This might include their age, employment status, and existing assets. A fair inheritance plan should provide for the long-term security and well-being of all heirs, ensuring they have the resources to pursue their goals and dreams. Professional guidance from a local Inheritance Planning expert can be invaluable in navigating these complexities and creating a plan that reflects your wishes while maintaining fairness across all beneficiaries.

Regular Review and Updates: Ensuring Your Plan Stays Current

An essential aspect of effective inheritance planning is regularly reviewing and updating your strategy. The legal and financial landscape is ever-changing, with new laws, regulations, and tax rules emerging frequently. As such, what was once a solid plan might become outdated quickly, leaving you vulnerable to potential pitfalls and unexpected costs. Regularly reviewing your inheritance planning ensures that any changes in your personal circumstances, such as marriage, divorce, birth of children, or significant life events, are reflected in your will and associated documents.

Additionally, tax laws related to inheritance planning can vary widely depending on your location, with different rules applying to property, investments, and other assets. By staying current with inheritance tax planning strategies near you, you can take advantage of legal loopholes, minimize the tax burden on your beneficiaries, and ensure that your wealth is distributed according to your wishes. This proactive approach guarantees that your plan remains robust and adaptable to life’s twists and turns.

Creating an effective inheritance plan involves a strategic approach to not only minimize taxes but also ensure your assets are distributed according to your wishes. By understanding the intricacies of inheritance planning, employing strategies for tax efficiency, and regularly reviewing your plan, you can leave a lasting legacy. Remember, seeking professional guidance from legal experts specializing in inheritance planning near you is key to navigating this complex process with confidence. Implement these essential tips to create a robust and fair inheritance plan that reflects your values and intentions.