Inheritance planning, a crucial yet often neglected aspect of financial strategy, involves creating a detailed plan for asset distribution upon your death. It protects legacies, maintains family harmony, and minimises tax implications. The process begins with identifying beneficiaries and understanding their financial needs. Crafting a comprehensive will is vital to ensure assets are distributed as per your wishes. Additionally, understanding tax implications through strategies like setting up trusts can maximise the preservation of your estate for future generations. For personalised guidance on inheritance planning near you, consult experienced professionals who can offer tailored advice based on individual needs and legal frameworks.

Effective inheritance planning is crucial for ensuring your wishes are respected and your assets are transferred smoothly. In this guide, we’ll explore top tips to navigate the complex landscape of inheritance planning near you. From understanding what it entails and identifying beneficiaries to crafting a comprehensive will and managing tax implications, these strategies will empower you to make informed decisions. Prepare to revolutionize your estate plan and secure a brighter future for your loved ones.

- Understanding Inheritance Planning: What It Entails and Why It Matters

- Identifying Beneficiaries: Ensuring Your Wishes Are Respected

- Crafting a Comprehensive Will: The Foundation of Your Plan

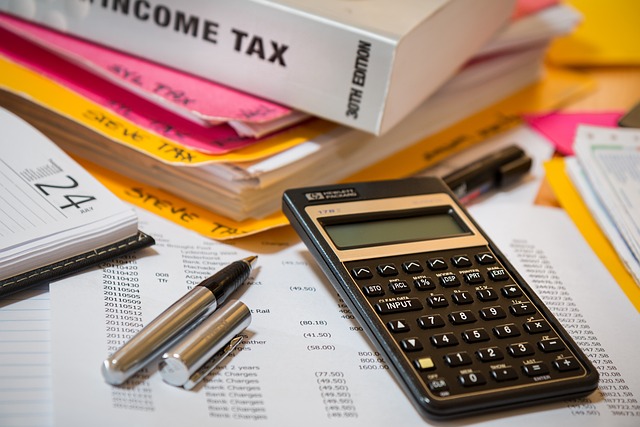

- Tax Implications and Estate Planning Strategies for Optimal Transfer

Understanding Inheritance Planning: What It Entails and Why It Matters

Inheritance planning is a critical yet often overlooked aspect of financial strategy, especially as we navigate the complexities of modern wealth management. It involves creating a comprehensive plan to distribute your assets and property upon your passing, ensuring that your wishes are respected and your loved ones are provided for. This process is not merely about legal formalities; it’s a way to protect your legacy, maintain family harmony, and even minimize potential tax implications.

Effective inheritance planning allows you to make informed decisions about how your hard-earned assets will be managed and transferred, ensuring that they serve the best interests of your beneficiaries. It encourages open communication about financial matters within families and can help avoid disputes or misunderstandings in the future. For those seeking guidance on inheritance planning near me, it’s advisable to consult with experienced professionals who can offer tailored advice based on individual needs and legal frameworks.

Identifying Beneficiaries: Ensuring Your Wishes Are Respected

When it comes to inheritance planning, identifying beneficiaries is a crucial step in ensuring your wishes are respected and your assets distributed according to your preferences. It’s important to consider who will benefit from your estate and why. Take the time to carefully select individuals or entities that align with your goals and values. This process involves more than just naming names; it requires an understanding of their financial situations, relationships with you, and long-term well-being.

In the context of Inheritance Planning Near Me, seeking professional advice is invaluable. A qualified estate planning attorney can guide you through this process, ensuring that your chosen beneficiaries are protected and that any potential disputes or misunderstandings are addressed proactively. They can also help tailor solutions tailored to your unique situation, making sure your inheritance plans are legally sound and ethically considered.

Crafting a Comprehensive Will: The Foundation of Your Plan

Crafting a comprehensive will is the cornerstone of any effective inheritance planning strategy. It serves as your legacy, ensuring your assets are distributed according to your wishes after your passing. This vital document not only outlines ownership of property and possessions but also names guardians for minor children and designates beneficiaries for various accounts like life insurance policies and retirement funds.

When considering inheritance planning near me, it’s crucial to engage the services of a qualified estate planning attorney. They can help tailor your will to your specific needs and circumstances, ensuring compliance with legal requirements and maximizing the efficiency of your plan. A well-crafted will is flexible, allowing for revisions as your life changes, making it an indispensable tool in securing your family’s future.

Tax Implications and Estate Planning Strategies for Optimal Transfer

When considering inheritance planning near me, it’s crucial to understand the tax implications that can significantly impact the transfer of assets. Estate planning strategies play a vital role in optimizing this process and ensuring your wishes are respected. By implementing thoughtful planning, you can minimize tax liabilities and preserve more of your estate for future generations.

One effective strategy is setting up trusts, which offer greater control over when and how assets are distributed. This is particularly beneficial for inheritance planning as it allows for tailored tax treatment and can help reduce the overall tax burden on beneficiaries. Consulting with a professional in your area who specializes in estate and inheritance planning can provide valuable insights into these strategies, ensuring optimal transfer while adhering to legal requirements.

Effective inheritance planning is not just about leaving behind assets; it’s about ensuring your wishes are respected and your loved ones are secure. By understanding the process, identifying beneficiaries, crafting a comprehensive will, and considering tax implications, you can achieve a seamless transfer of your estate. Remember, professional guidance from an Inheritance Planning Near Me expert can make all the difference in creating a personalized strategy that meets your unique needs. Take control of your future today.